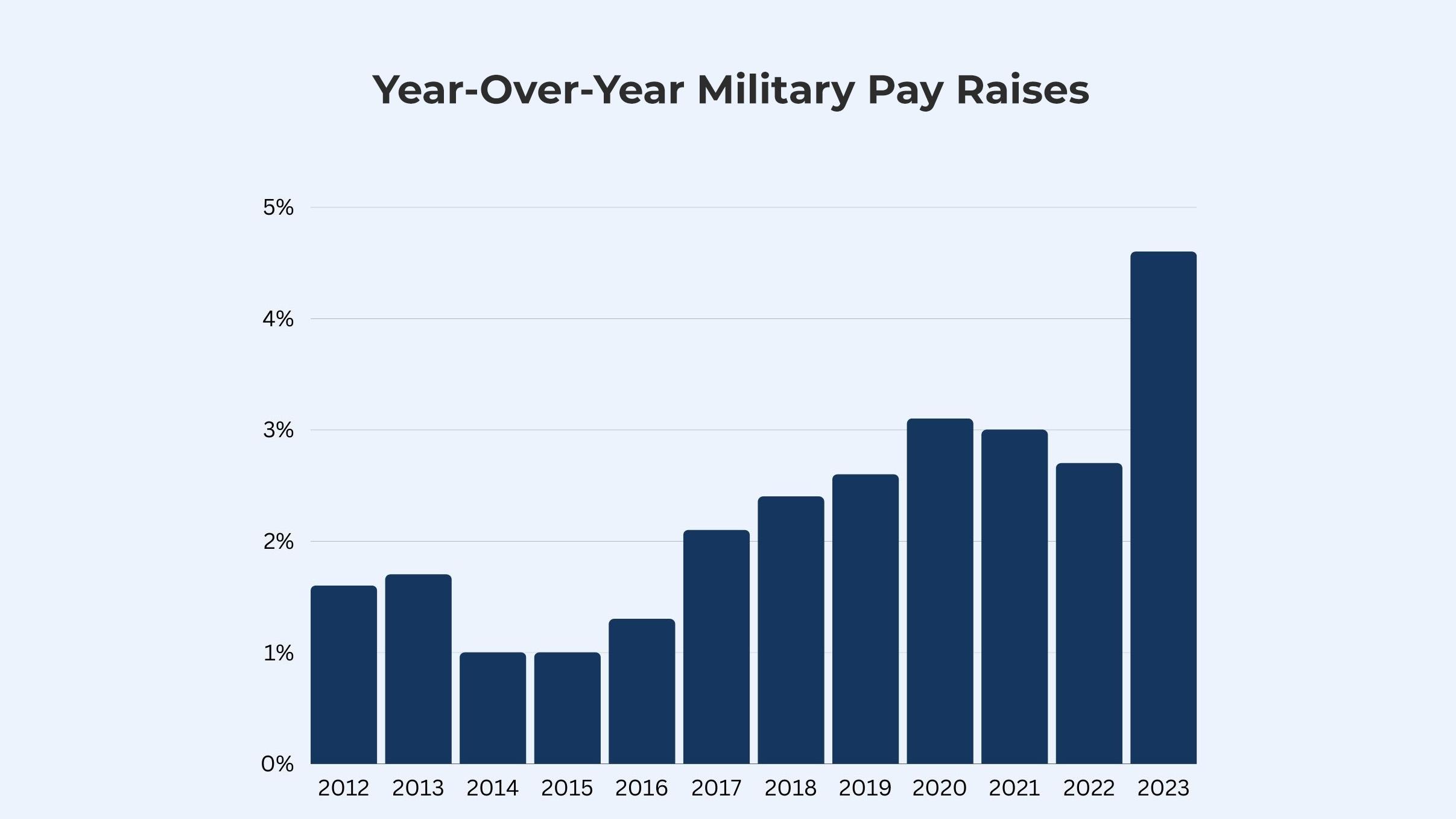

Military Bas Rate - The basic allowance rates (BAS) for 2023 have been announced. This year's increase is the largest in decades!

BAS is a tax-free cash benefit paid to all military personnel upon completion of basic military training, except in certain circumstances where meals are provided by the military. This is a legacy from the days when soldiers received all their meals. Some call it "military quota."

Military Bas Rate

These changes will take effect on January 1, 2023, so the new rates will appear on payments on January 13, 2023.

Meal Deduction: Do Airmen Really Need It? > Shaw Air Force Base > Display

There is also an item called BAS II which "may be paid to enlisted members who serve in a special station and are assigned to a single government house (non-member) that does not have adequate food storage or preparation facilities and where the government mess is not available. The government cannot provide food otherwise, the BAS II level is twice the listed BAS level and must be approved by the Secretary of the appropriate Military Department.

I have done tons of research on this and have not found an answer. The answers I got didn't make much sense. If you have a real answer, and not just "well, because officers get more", I'd like to hear it.

In theory, the BAS is always taken when the army provides all the reinforcements. In fact, sometimes the military provides all meals and takes BAS, and sometimes it provides all meals and does not. Different situations are handled differently and there are tons of variables. It is best to assume that BAS will not be paid every time a service member receives any meal, even an MRE. (These things are expensive.)

BAS is not intended to feed your family, it is intended to pay the cost of feeding a service member. It certainly becomes part of the regular budget of many families. It's a good thing and a bad thing. On the other hand, it is a little extra income every month. The downside is that some fields are often taken out of BAS, such as field training, and then the family budget is short.

Concrete Experience What Can The Army Do Better To Ensure Our Soldiers Are Properly Trained In Basic Personal Financial Management?

This is the largest increase in some time due to higher food costs in 2021. When planning your spending for 2022, be sure to consider BAS in a way that it can change if the service member is in training or is subsidized and receiving food, ie. that this allowance cannot be paid.

Let me help you stay on top of your military pay and benefits! Sign up now to receive my weekly news emails. Basic Subsistence Allowance (BAS) is a tax-free monthly allowance that helps cover some of the cost of food and meals for US military personnel.

Advertiser Disclosure: Opinions, reviews, analysis and recommendations are solely those of the author. This article may contain links from our advertisers. Please see our Advertising Policies for more information.

When you move from one station to another, there is so much air in the air that the last thing you need to worry about is having enough money for food and meals. Basic Subsistence Allowance (BAS) is intended to cover the cost of meals for service members. Let's look at the nature of BAS, who is eligible and how BAS differs from BAH.

Postscript Of The Apache Sentinel, 1945 11 09

BAS is a tax-free monthly amount that helps cover some of the costs of meals and food. The rates increase each year to keep pace with changes in the food cost index set by the Department of Agriculture (USDA).

Living and Clothing Allowances appear on your Leave and Earnings Statement and can be considered credit against your VA Home Loan. Additionally, these two allowances are tax-free, which means lenders can add those incomes together to calculate your debt-to-income ratio when you qualify for a VA home loan.

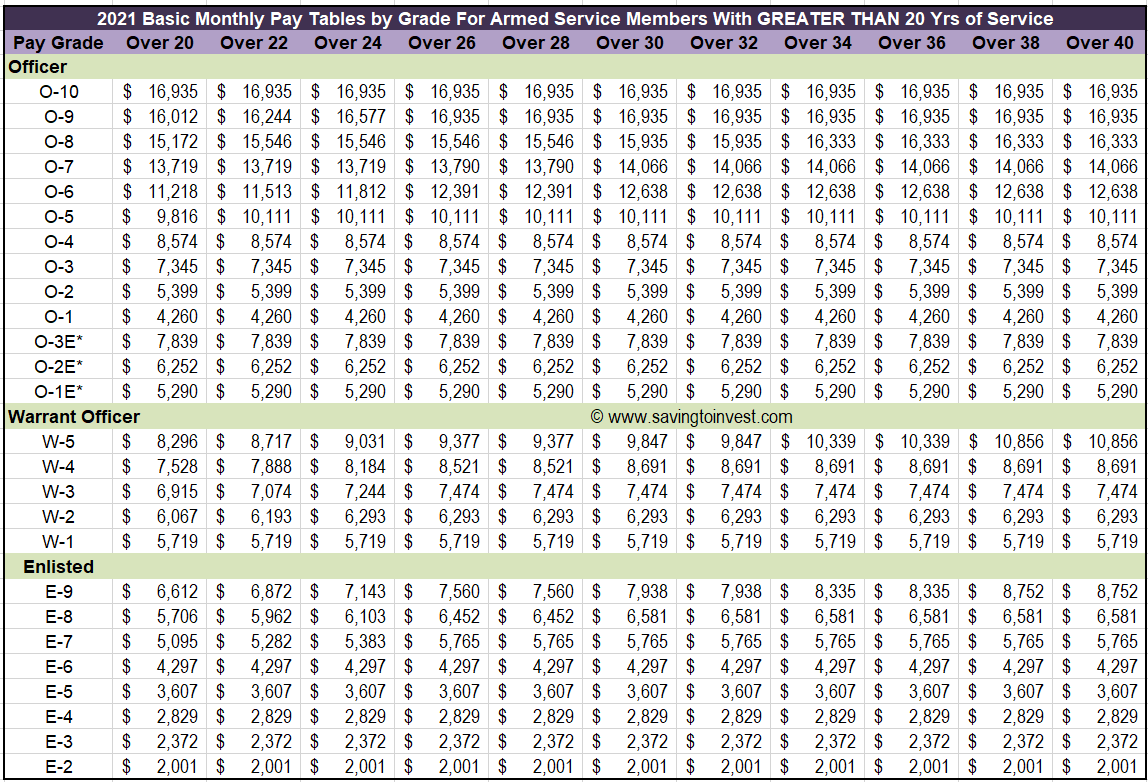

According to the US Department of Defense, in 2023 there will be an 11.2% increase in BAS. Beginning January 1, 2023, registered members will receive $452.56 per month, an increase of $45.58 from 2022. Officers will receive $311.68, an increase of $31.39.

BAS is available to all service members. All members are required to pay for their own meals, including enlisted members for whom meals are provided (for example, those living in camps or dormitories).

At Fort Riley And Elsewhere, Entitlements Can Vary Based On Location

Funds are paid directly to the service member or can be accessed through the meal card administration system. Service members in OCONUS areas (outside the continental United States) may also be eligible for a monthly Cost of Living Allowance (COLA) to help cover additional food costs. COLA is not subject to BAS rates.

USDA evaluates current food costs in the continental United States USDA evaluates current food costs in the continental United States to help determine future BAS levels. These rates are related to the total cost of food in a given zip code. In this way, BAS is similar to Basic Housing Allowance (BAH). However, BAS rates are estimated across zip codes and are used worldwide, while BAH rates are based on the service member's location.

Active duty members of the Army, Air Force, Navy, Marine Corps, and Air Force are eligible for BAS. This applies to enlisted personnel and an officer who lives outside the installation and receives a separate ration exemption.

Reserve service members who are eligible for basic pay are also eligible for BAS, except for employees undergoing recruitment training. Reservists are only eligible for BAS when they are on active duty, such as when they are on Guard Reserve orders when they are activated or their unit is activated. Fees are calculated based on the number of days worked.

Basic Allowance For Housing (bah) Rates

BAS is not issued to service members who are deployed or on temporary duty during field training (FTX). During FTX, food is provided to service members and their units.

If the service member has FTX, the BAS should be adjusted to reflect the meals he was given in the field, even if those meals were ready-to-eat meals.

Note: The cost of field meals is deducted from the monthly allowance for officers and enlisted men. Although this rule applies, some entities do not remove the BAS for protocol reasons. Implementation largely depends on who is appointed to handle the paperwork and individual pressure is under to save money.

Officers entitled to basic pay are entitled to BAS, unless they are on extended leave or absent without leave for more than 24 hours. Officers are not entitled to equipment allowance. This means that they must pay for all meals at food service centers (DFACs)/mess or organizations that collect rations while on field service.

Frequently Asked Questions About Conus Cola

All employees who are entitled to basic pay are entitled to continue BAS, unless:

Essential Station Messing (ESM) is a form of nutrition. ESM is probably not new to you, unless you were a young person who was unaccompanied. ESM is an important part of the total compensation package provided to service members. ESM replaces BAS as lower service members have access to DFAC/mess/kitchen.

The main difference between Basic Living Allowance and Basic Housing Allowance is that BAS is only given to a service member. The BAS rate remains the same regardless of how many dependents a service member has.

BAH rates, on the other hand, are determined not only by zip code, but also by whether or not the service member has dependents.

Fact Check: Claims On Leaders' Deaths, Vaccines Are False

BAS II is a monthly stipend paid to enlisted members in permanent housing units of one government that do not have adequate food reserves. This benefit is only available if there are no DFAC/mes available on the installation - and no preparation facilities - or the military cannot provide meals otherwise. BAS II standards are twice the standard standards and must be approved by the secretary of the military department concerned.

Although BAS is intended to provide a food allowance for a service member, there may be additional food allowances or benefits for low-income military families. These include the Supplemental Nutrition Assistance Program (SNAP) and the Family Living Allowance (FSSA).

SNAP is only available in the continental United States (CONUS), while FSSA is an overseas program (OCONUS). Finally, some military families with young children may also qualify for WIC.

To reflect the current state of the global pandemic, the Department of Defense has released a comprehensive BAS guide. This information does not apply to service personnel who are entitled to isolation or quarantine allowance.

Thanks To Missile Sales To Uae, Us Army Can Buy 100 More Advanced Patriot Missiles

If an active duty service member is ordered to restrict their movement for surveillance purposes, the following rules apply to BAS:

This important benefit is an important part of the general benefits provided to the military. For more information, please visit the Defense Financial Accounting Service website for compensation and compensation eligibility tables. You can also view the detailed DoD financial management regulations here.

Jessica Evans is a Cincinnati native who has a chance to reinvent her home

:max_bytes(150000):strip_icc()/GettyImages-154955639-a1b3a3be87c6432e987778af8db2c82f.jpg)